|

LINKS-ДАЙДЖЕСТ 13 марта 2012 г. Япония сможет покупать гособлигации КНР Германии все труднее оставаться примером для ЕС Moody's срезало рейтинг Кипра до "мусорного" уровня Япония даст банкам еще 2 трлн иен Fitch повысило долгосрочный рейтинг Греции Ecofin решит судьбу Португалии "Стерилизованные покупки" ФРС Дефицит бюджета США может составить $1,3 трлн Moody's: банки США не провалят стресс-тесты Розничные продажи в США достигли максимума за 5 мес. .................................................................................... теперь англоязычные JPMorgan announced a $15 billion stock buyback program JPMorgan объявил байбэк NEW YORK--(BUSINESS WIRE)--JPMorgan Chase & Co. (NYSE: JPM) today announced the following actions taken by its Board of Directors: - Declared a quarterly dividend of $0.30 per share on the corporation's common stock, an increase of $0.05 per share. The dividend is payable on April 30, 2012 to stockholders of record at the close of business on April 5, 2012

- Authorized a new $15 billion equity repurchase program, of which up to $12 billion is approved for 2012 and up to an additional $3 billion is approved through the end of the first quarter of 2013

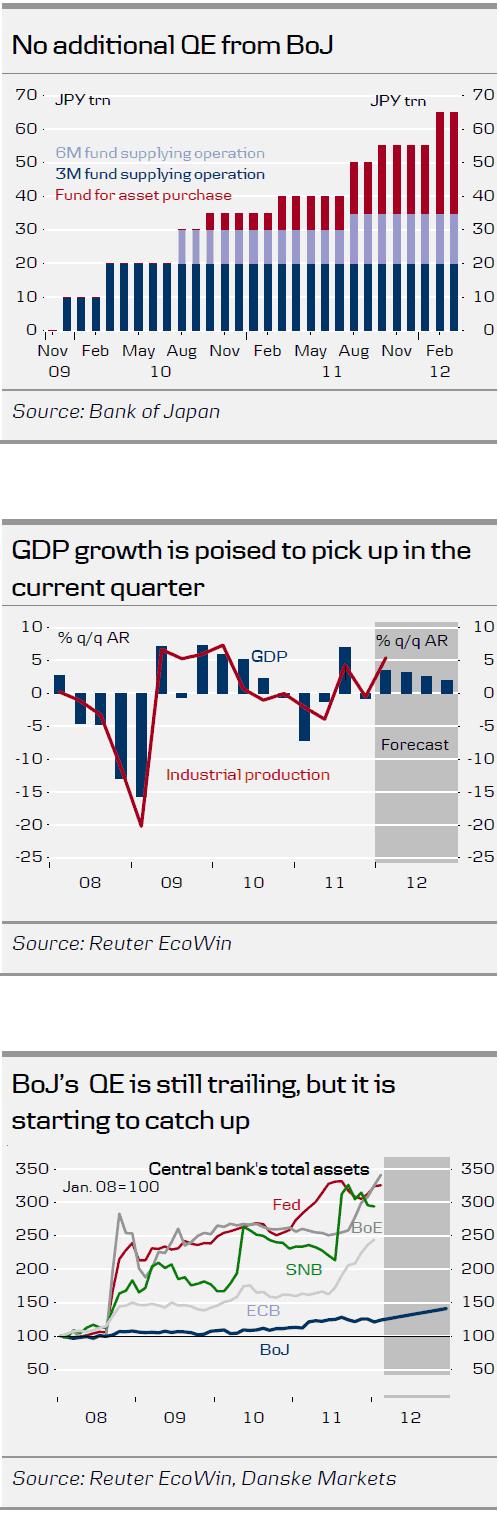

Дивиденды будут выплачены акционерам, которые окажутся в реестре на закрытие рынка 5 апреля 2012 года. Из 15 млрд. выкупа акций на 2012 год установлен лимит в 12 млрд,, еще 3 млрд. – в первом квартале будущего года. Однако: The timing and exact amount of common stock and warrant purchases will be consistent with the Firm’s capital plan and will depend on various factors, including market conditions, the Firm's capital position, internal capital generation, and organic investment opportunities. The new repurchase program does not include specific price targets, may be executed through open market purchases or privately negotiated transactions, including utilizing Rule 10b5-1 programs, and may be suspended at any time. The equity repurchase program replaces the prior $15 billion program that had approximately $6.05 billion of remaining authorization. JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $2.3 trillion and operations in more than 60 countries. The firm is a leader in investment banking, financial services for consumers, small business and commercial banking, financial transaction processing, asset management and private equity. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of consumers in the United States and many of the world’s most prominent corporate, institutional and government clients under its J.P. Morgan and Chase brands. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com. Хочу обратить внимание на следующие моменты в заявлении JPMorgan. Программа по выкупу акций призвана заменить действующую предыдущую программу с таким же объемом, выполнение которой еще пока не закончено – осталось по ней купить акций на 6,05 млрд. долларов. Новая программа выкупа может быть приостановлена в любой момент. По сути никакого нового байбэка нет. Это всего лишь свист – рыночная манипуляция. Why JPMorgan's Buyback Announcement Just Sent The Entire Stock Market Soaring Почему объявление JPMorgan о байбэке привело к бурному росту рынка EL-ERIAN: Get Ready For Greek Debt Restructuring Phase II Готовьтесь ко второй фазе реструктуризации греческого долга Presenting Bridgewater's Weimar Hyperinflationary Case Study Представляя кейс от Bridgewater ( наиболее успешный хеджфонд) по гиперинфляции в Веймарской республике VIX Plunges To 5 Year Low Индекс волатильности VIX снизился до 5-тилетних минимумов VIX at its lowest (sub-14%) since Summer 2007... and the Volatility term structure, its steepest EVER... Short-term volatility (risk) is the lowest relative to medium-term risk EVER - is this the biggest ever levered bet on FOMC calmness into European election event risk? Or more technically is this late forced unwinds of legacy long vol/steepeners into the Greece March 20th event risk (which seemed like a decent trade looking for a risk-flare). Given the steepness of the rest of the curve, it certainly feels very technical (flow) driven. Hedge Funder John Taylor Explains Why The Yen Has Been Tanking Крупнейший управляющий валютным фондом объясняет, почему падает йена. Падающая йена – признак крупных проблем, стоящих перед Японией? Вовсе нет. В недавней записке глава крупнейшего валютного фонда Джон Тейлор объясняет, что двигает йену. Is the tanking yen -- which we just covered -- a sign of some major problem coming to Japan? No, not really. In a recent note, John Taylor of currency hedge fund FX Concepts explains what drives the yen... it's basically risk appetite. When people want to take more risk, they dump yen. And for the first time in a while, people are feeling good. That being said, Taylor doesn't expect this to last, and he expects the yen to hit new highs later this year. Дело вовсе не в каких-то проблемах в самой Японии. На йену давит аппетит к риску. Когда хотят взять больше риска, то продают йену. И первое время люди в целом чувствуют себя хорошо. Можно сказать, что Джон Тейлор не ожидает, что это продлится долго и йена в этом году опять достигнет новых максимумов. Тейлор также объясняет: С момента финансового кризиса 2007 года йена укрепилась сильнее, чем ей следовало бы. Йена сильно коррелирует с бизнесциклом, почти так же как доллар, даже сильнее. Когда на рынке настает коллапс, управляющие хеджфондов продают активы и покупают йену. От этого она становится сильнее. Bottom line: At least for now: What drives the yen is the alternation between risk on and risk off, whether Japanese investors are investing abroad, and whether hedge funders are borrowing in yen to buy various assets. When people are investing more and taking risks, that's yen negative. Japan's Shocking Keynesian Slip: "We Are Worse Than Greece" Самокритика японского министра финансов: он признал, что ситуация с бюджетом в Японии даже хуже, чем в Греции In a stunning turn of events, a Japanese Ministry of Finance official admits to Richard Koo's worst nightmare "Japan is fiscally worse than Greece". Bloomberg is reporting that, at a conference in Tokyo, Yasushi Kinoshita says Japan's 2011 fiscal deficit was up to 10% of GDP and its debt-to-GDP has soared to over 230%. What is more concerning is the Kyle-Bass- / Hugh-Hendry-recognized concentration risk that Kinoshita admits to also - with a large amount of JGBs held domestically, the Japanese financial system is much more vulnerable to fiscal shocks (cough energy price cough) than Europe. This Is What It Means When People Talk About 'Sterilized' QE О стерилизационном QE A Humorous Glossary Of Important Financial Terms Юмористический глоссарий важных финансовых терминов February Retail Sales Hit Expectations With Good Upward Revisions And Strong Sales Ex-Autos Февральские розничные продажи превзошли ожидания с заметным улучшением прежних данных и сильными продажами без учета автомобилей Why Everyone's Freaked Out About Portugal In One Huge Slide Почему страшно за Португалию с помощью одного слайда Why The Outcome Of The French Election Next Month Really Doesn't Matter Почему исход президентских выборов во Франции в следующем месяце в реальности не играет роли Bank Of America: The 4 Biggest Risks To The Bull Market BofA: 4 наибольших риска для рынка акций FAIL: 84% Of Actively Managed Mutual Funds Did Worse Than Their Benchmarks In 2011 84% активно управляемых взаимных фонда показали результаты хуже, чем их «эталон» This Is The Fed's Worst-Case Doom Scenario For The US Economy Фед только что объявил, что результаты последнего раунда стресстестов станут известны в четверг в 16.30 ( 0.30 по Москве пятницы) The Fed just announced that the latest round of bank stress tests will come out Thursday at 4:30 PM ET. As a reminder, this is the doom scenario banks will be stress tested against: No Real Easing from Bank of Japan This Time Danske Bank про сегодняшнее заседание Банка Японии - The Bank of Japan (BoJ) as expected left its leading interest rate and the size of its quantitative easing programme unchanged in connection with today's monetary meeting. It did increase the size of funds available in a long-term growth fund by JPY2trn, but this should not be regarded as a major easing move. BoJ's view of the economy was slightly more positive.

- With growth rebounding, we do not expect the ceiling for asset purchases to be raised further in H1 12 unless JPY for some reason resumes its appreciation path. However, we do expect the ceiling for asset purchases to be raised further in H2 12 to create space for continued asset purchases in 2013.

Как и ожидалось, Банк Японии (BoJ) оставил ставку и объем программы QE без изменений. Он только увеличил на 2 трлн. долларов размеры фонда по поддержке роста (GSFF). BoJ announced that it will add JPY2trn to its Growth-Supporting Funding Facility (GSFF) so that total resources in the GSFF are now JPY5.5trn. The purpose of GSFF is to extend loans to projects that support longer-term structural adjustment in the Japanese economy. BoJ does not regard the GSFF as part of the QE programme. In addition, the increase in the EFSF is too small compared with the overall size of the QE programme to make a big difference. Hence, it would be wrong to regard today's increase in GSFF as a major easing move by BoJ. However, one board member (Miyao) proposed a JPY5trn increase in the asset purchase programme, but the rest of the nine BoJ board members voted against the proposal. BoJ's view of the economy was slightly more positive. Regarding economic activity, it stated, "...it has remained more or less flat, although it is showing signs of picking up". In the statement from the previous meeting, BoJ just said, "economic activity has been more or less flat". И оценка будущей монетарной политики BOJ: With growth improving and growth possible exceeding 3% q/q AR in Q1 12, we do not expect BoJ to raise the ceiling for asset purchases further. The implication of the 1% inflation target introduced at the previous monetary meeting is, in our view, that the ceiling for asset purchases will be raised further at some stage in H2 12 to create space for continued asset purchases in 2013. Should JPY for some reason resume its appreciation path, this would force an earlier and larger expansion of the asset purchases. We think renewed intervention in the FX market in unlikely unless USD/JPY breaks below 75.5. While BoJ's QE continues to trail other major central banks, it has started to catch up and will probably continue its asset purchases longer than most other major central banks. Danske Bank не ожидает продолжения QE в первом полугодии, а во втором считает вероятным.

Preview: US FOMC Statement - 3 Scenario & Expectations К предстоящему заседанию ФОМС

|