|

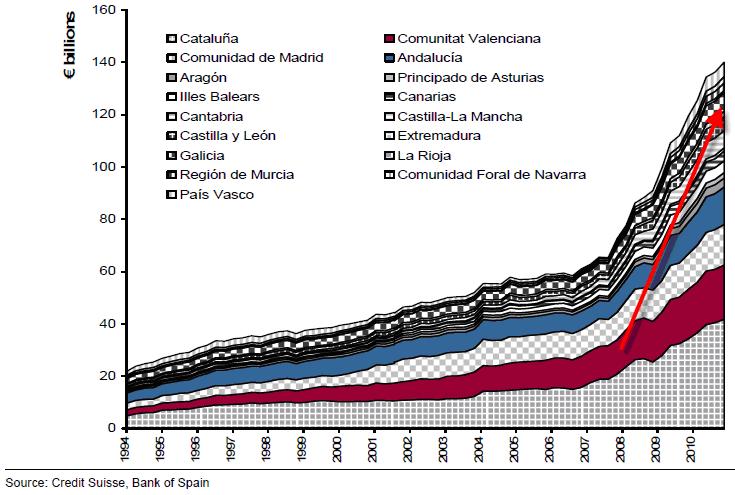

LINKS-ДАЙДЖЕСТ 30 марта 2012 г. Это ДАЙДЖЕСТ ссылок на аналитические материалы, главным образом англоязычные. Корея уходит от доллара ЦБ Кореи снизил долю американского доллара в своих ЗВР до минимального уровня с 2007 г., когда началась публикация подобной статистики. Корея снижает долю долларов и евро в своих ЗВР и покупает юани Доллар занимает 60,5% от общего объема ЗВР Южной Кореи, которые на начало 2012 г. составляли $306,4 млрд. Годом раньше в долларах хранилось 63,7% от всех запасов. Монетарные власти Кореи взяли курс на повышение разнообразия валют: за последний год они увеличили доли австралийского доллара и китайского юаня, в то время как количество долларов и евро уменьшилось. ЦБ Кореи увеличил долю акций в своем портфеле с 3,8% в начале 2011 г. до 5,4% в начале 2012 г. Доля гособлигаций увеличилась на 1% до 36,8%. Японцы начали тратить больше Дефляция постепенно отступает: индекс потребительских цен впервые за последние 5 месяцев демонстрирует положительную динамику. Он увеличился на 0,2% м/м и на 0,1% г/г. По прогнозам экспертов статистического отдела Министерства внутренних дел Японии, в марте промпроизводство вырастет на 2,6% и на 0,7% в апреле. Последний прогноз ОЭСР указывает на то, что темпы роста японской экономики станут самыми заметными среди развитых стран. В I квартале ВВП страны увеличится на 3,4%. Еврогруппа согласовала размер стабфонда Поможет ли Европе копенгагенский компромисс? Экономия по-португальски Еврозоне необходим взаимный финансовый контроль Goldman Sachs пересматривает прогнозы цен на сырье Дадли: ФРС держит европейские облигации .................................................................................... теперь англоязычные ........................................................................................... Massive $17 Trillion Hole Found In Obamacare Республиканец Jeff Sessions нашел разрыв в доходах и расходах по социальным статьям в 17 трлн. долларов. That someone is Republican Jeff Sessions who after actually running the numbers has uncovered that the true long-term funding gap is a mind-boggling $17 trillion, just a tad more than the original sub $1 trillion forecast. This latest revelation means that total underfunded US welfare liabilities: Medicare, Medicaid and social security now amount to $99 trillion! Add to this total US debt which in 2 months will be $16 trillion, and one can see why Japan, which is about to breach 1 quadrillion in total debt (yen, but who's counting), may want to start looking in the rearview mirror for up and comer competitors. And while Obama may have been taking creative license with a number that is greater than total US GDP, he was most certainly correct when saying that Obamacare would not add a penny to US debt. Because the second the US government comes to market to fund a true total debt/GDP ratio of 750%, it is game over, and the Fed will have its hands full selling Treasury puts every waking nanosecond to have any time left for the daily 3pm stock market ramp. Is Spanish Regional Debt Out Of Control? Региональный долг Испании значительно увеличился в последнее время Spanish regional debt currently stands at 13% of GDP and has surged from EUR60bn in 2006 to over EUR140bn currently. As Credit Suisse points out, the top four regions account for the majority of GDP, two-thirds of regional debt, and, with the exception of Madrid, substantially missed their deficit targets. What is more worrisome is the heavily front-loaded nature of the maturing debt with substantial refinancing needs in the next 2 years and this regional debt is split between bonds and loans - with many of the latter from Spanish banks - yet another illustration of the interconnected contagion that is building more rapidly. The growing crisis in refinancing (liquidity and costs) for regional debt developed the idea of Ponzibonos 'Hispabonos' - debt issued by regions but guaranteed by the central government. The conditionality of these guarantees with regard to deficit targets wil be critical but once they are issued, the risk is that the regions are unable to get their finances under control, the Spanish debtload increases, and there is no longer the flexibility for a regional debt restructuring, should one be necessary.

Притом долг в основном краткосрочный  MarketWatch Goes Full Propaganda Retard Банки так загружены акциями, что у них нет другого выбора, как продолжать ралли. Yup - the banks are so loaded up with toxic stocks that they have NO CHOICE but to keep the ramp accelerating higher and higher until "stupid" retail comes back in and distribution happens, leaving the retail investor holding the hollow bag again. Alas, there were no inflows this week either. Which means that just like Italian banks, the meltup could well accelerate even more from here. Another Failed Grand Plan In Europe Via Peter Tchir of TF Market Advisors, European Sovereign Yields have been under pressure for most of the last month...seems the market doesn't buy the firewall idea... Почему не работает идея EFSF/ESM? So at some point in the near future there will be about €40 billion of money sitting in the ESM and a bunch of promises from countries failing to live up to existing debt obligations, and that is the big firewall? The correlation between who is providing the guarantees and who will need them cannot be ignored. This new €500 billion number doesn’t exist, it’s not just meaningless, it’s non-existent if Italy or Spain needs money. People can take away whatever they want, but unlike LTRO which had real injections of liquidity, this is just like the July plans from last year and the November “grand” plans. It sounds great, especially when too many people are willing to blindly follow what the politicians want them to, but it doesn’t work in practice. Mark Grant Explains The Farce, The Hustle, And The Scam Все разговоры о размерах фондов EFSF/ESM – обман с целью отвлечь внимание. Это лишь обещание заплатить, а не сами деньги. When considering the financial condition of each and every country in the European Union there are certain facts that are left out and left out on purpose. In our opinion, the structural deformity of the European Union is, in itself, one of the main reasons that any attempt at a fiscal or economic fix never seems to work. Whether some proposed firewall is $760 billion or $1.3 Trillion or $13 Trillion makes no difference as in zero, nada, nothing and null. It is an IOU, a promise to pay and it is not counted in any European sovereign debt numbers nor is it counted in the figures for the European Union’s debt. It will not stop Spain or Portugal or Italy from asking for or needing money. This whole discussion is a head fake, a deception and a ruse carefully plotted out for investors in one more attempt to mislead the entire world. If you wish to be a statistic in the Greater Fool Theory be my guest but I refuse to be apart of this unadulterated scam. European Bailout Stigma Shifts From Banks To Sovereigns As Bundesbank Refuses PIG Collateral Германский Бундесбанк отказался принимать в залог бонды, гарантированные государствами, получившими помощь от Евросоюза и МВФ Germany’s Bundesbank is the first of the 17 euro-area central banks to refuse to accept as collateral bank bonds guaranteed by member states receiving aid from the European Union and the International Monetary Fund, Frankfurter Allgemeine Zeitung reported. And what happens then? Since it is inevitable that Spain and Italy will be next on the bailout wagon, what happens when over $2 trillion in bonds suddenly become ineligible for cash collateral from the only solvent central bank in the world (aside for that modest, little TARGET2 issue of course). Will it force the ECB to be ever more lenient with collateral, and how long until the plebs finally realize that the ECB has been doing nothing but outright printing in the past 5 months? What happens to inflationary expectations then? Must Read: Jim Grant Crucifies The Fed; Explains Why A Gold Standard Is The Best Option Джим Грант критикует политику Федрезерва. Очень классная статья! I can’t help but feel slightly hypocritical in dressing you down. What passes for sound doctrine in 21st-century central banking—so-called financial repression, interest-rate manipulation, stock-price levitation and money printing under the frosted-glass term “quantitative easing”—presents us at Grant’s with a nearly endless supply of good copy. .... One can think of the original Federal Reserve note as a kind of derivative. It derived its value chiefly from gold, into which it was lawfully exchangeable. Now that the Federal Reserve note is exchangeable into nothing except small change, it is a derivative without an underlier. Or, at a stretch, one might say it is a derivative that secures its value from the wisdom of Congress and the foresight and judgment of the monetary scholars at the Federal Reserve. Either way, we would seem to be in dangerous, uncharted waters. ................................. As you prepare to mark the Fed’s centenary, may I urge you to reflect on just how far you have wandered from the intentions of the founders? The institution they envisioned would operate passively, through the discount window. It would not create credit but rather liquefy the existing stock of credit by turning good-quality commercial bills into cash— temporarily. This it would do according to the demands of the seasons and the cycle. The Fed would respond to the community, not try to anticipate or lead it. It would not override the price mechanism— as today’s Fed seems to do at every available opportunity—but yield to it. Ladies and gentlemen, such stability as might be imposed on a dynamic capitalist economy is the kind that eventually comes around to bite the stabilizer. .............................. “Price stability” is a case in point. It is your mandate, or half of your mandate, I realize, but it does grievous harm, as defined. For reasons you never exactlyspell out, you pledge to resist “deflation.” You won’t put up with it, you keep on saying—something about Japan’s lost decade or the Great Depression. But you never say what deflation really is. Let me attempt a definition. Deflation is a derangement of debt, a symptom of which is falling prices. In a credit crisis, when inventories become unfinanceable, merchandise is thrown on the market and prices fall. That’s deflation. What deflation is not is a drop in prices caused by a technology-enhanced decline in the costs of production. That’s called progress. ............................................ Much the same sentiments, and much the same circumstances, apply today, but with a difference. Digital technology and a globalized labor force have brought down production costs. But, the central bankers declare, prices must not fall. On the contrary, they must rise by 2% a year. To engineer this up-creep, the Bernankes, the Kings, the Draghis—and yes, sadly, even the Dudleys—of the world monetize assets and push down interest rates. They do this to conquer deflation. But note, please, that the suppression of interest rates and the conjuring of liquidity set in motion waves of speculative lending and borrowing. This artificially induced activity serves to lift the prices of a favored class of asset—houses, for instance, or Mitt Romney’s portfolio of leveraged companies. And when the central bank-financed bubble bursts, credit contracts, leveraged businesses teeter, inventories are liquidated and prices weaken. In short, a process is set in motion resembling a real deflation, which then calls forth a new bout of monetary intervention. By trying to forestall an imagined deflation, the Federal Reserve comes perilously close to instigating the real thing.

|