|

Этот LINKS-дайджест посвящен греческому долговому свопу Greek PSI — the results Прессрелиз Greek PSI — the implications Значение греческого долгового свопа Мнение JPM Debt held in private hands following the PSI will be around €70 billion (less than a quarter of total debt), and will mature in 10 to 30 years. A large part of the value of this debt will be in the coupons it pays, but the funds earmarked for this in the second package will be in an escrow account outside of the Greek government’s control. В руках частного сектора теперь остается всего около четверти от всего долга – порядка 70%.

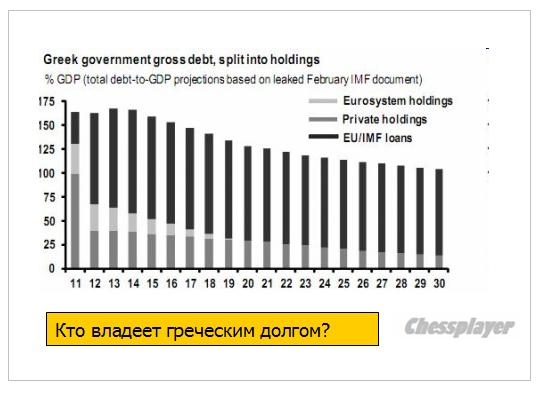

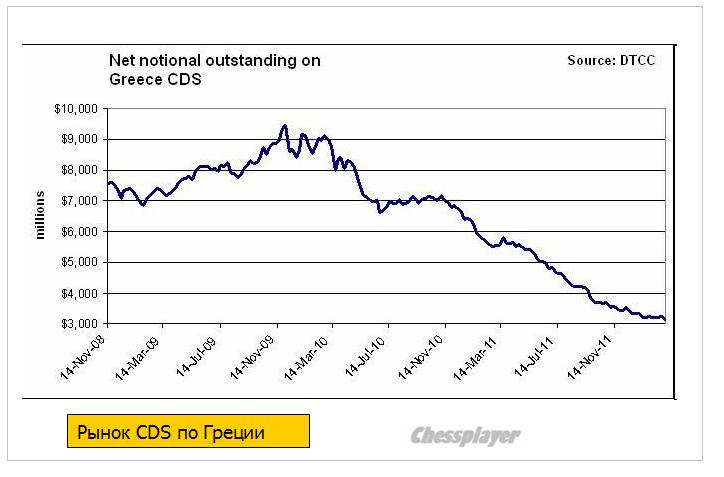

Barring a Greek exit from the Euro area, there is not much scope for a default on privately held debt in the near term. With more than 75% of outstanding standing debt held in official hands (including Eurosystem holdings) after the PSI, official sector involvement will be key for providing Greece with debt relief. This creates political issues which can be dealt with over time, and in ways which are optically more favorable for taxpayers (e.g., through very long maturity extensions). Теперь 75% греческого долга находится в руках официальных институтов, что переводит греческий долг в разряд политических тем. The more immediate issue is the funding shortfall that Greece will experience in the near term, which we estimate to be €20 billion in 2012-14. Arguably, this is a modest amount relative to what has been disbursed thus far, and the Troika may just fill this gap. But, further disbursements may find political resistance, especially if Greece is seen as making insufficient progress on fiscal and structural reforms. Barring additional support, Greece could increase issuance of T-bills, reduce the cash buffer, default on maturing bonds held by the ECB or amortizing IMF loans, not pay arrears or avoid recapitalizing social security funds, or close the primary deficit more abruptly. Depending on the strategy chosen, there is a risk of antagonizing European counterparts (which could threaten Greece with cutting off support, e.g., through the ECB), or antagonizing Greek society (through forced front-loaded tightening). Unless the situation is managed properly, Greece could end up leaving the Euro area. This is not our central view, but a risk that cannot be neglected. Вопрос выхода Греции из еврозоны вовсе не снят с повестки дня. Isda Greece credit event? There is Кредитное событие по Греции состоялось. Key points from the Isda FAQ on the Greece credit event “YES”... Что дальше? Now that a credit event has occurred, what happens next? Market participants conduct an auction through which the recovery value of Greek debt is determined. This recovery value determines the net payouts made under CDS contracts when a credit event occurs. The DC determined that an auction will be held in respect of outstanding Greek sovereign CDS transactions on March 19. Аукцион по транзакциям, касающимся греческих CDS, назначен на 19 марта. Сколько будет выплачено? How much will be paid out now that a CDS credit event has been triggered? According to the Depository Trust & Clearing Corporation’s CDS data warehouse, the total net exposure of market participants who have sold CDS credit protection on Greek sovereign debt is approximately $3.2bn as of March 2, 2012. The net cash payout on CDS when a credit event occurs is the face amount of the CDS contract less the recovery value of the underlying obligations as determined at a CDS auction. For example, if the CDS auction showed the recovery value of debt to be (hypothetically) 25%, the aggregate amount payable would, in Greece’s case, be 75% of $3.2bn: $2.4bn. Furthermore, statistics indicate that, on average, 70% of derivatives exposure is collateralized and the level of CDS collateralization is likely to be even higher as over 90% of CDS transactions (by numbers of trades) are collateralized. Разные детали. How can an auction be held if there are no “old bonds” because they have been exchanged for new bonds? The EMEA Determinations Committee will ultimately decide which of the obligations are deliverable under the Credit Derivatives Definitions for purposes of the Greek CDS settlement auction. It is important to note that Greece has outstanding a wide variety of obligations. Not all existing bonds are covered by the use of CACs. In addition, new bonds are being issued that might satisfy the requirements for deliverable obligations. Следующий график дает представление о рынке CDS Греции.

Следующая статья очень содержательна OpenEurope Verdict On Greek PSI - Pyrrhic Victory Sowing Seeds Of A Political And Economic Crisis In Europe In a just released report from Europe think tank OpenEurope, the conclusion is far less optimistic: "The deal sets the eurozone up for a political row involving Triple-A countries. At the start of this year, 36% of Greece’s debt was held by taxpayer-backed institutions (ECB, IMF, EFSF). By 2015, following the voluntary restructuring and the second bailout, the share could increase to as much as 85%, meaning that Greece’s debt will be overwhelmingly owned by eurozone taxpayers – putting them at risk of large losses under a future default. This deal may have sown the seeds of a major political and economic crisis at the heart of Europe, which in the medium and long term further threatens the stability of the eurozone." Сделка по греческому долгу означает, что теперь большая часть риска в случае будущего дефолта переведена на европейских налогоплательщиков. Радость понятна – Греция избежала хаотического и непредсказуемого развала. Однако эта сделка может оказаться пирровой победой. Open Europe’s Head of Economic Research Raoul Ruparel said, “With the use of CACs Greece has entered a coercive restructuring or default – something which Greece and the eurozone have spent two years trying to avoid. While the financial markets can handle the triggering of CDS that this will entail, at some point serious questions need to be asked over the amount of time and money which policymakers have wasted on what has ultimately amounted to a failed policy. Instead, Greece should have undergone a full restructuring combined with a series of pro-growth measures.” “There will be plenty of optimism in the corridors of power around the eurozone today, some of it justified – Greece has avoided a chaotic and unpredictable meltdown. However, this deal could end up being a pyrrhic victory: the debt relief for Greece is far too small which means that another default could be around the corner, while the austerity targets are wholly unrealistic and kill off growth prospects. Furthermore, Greece’s debt will end up being almost completely owned by eurozone taxpayers and by exempting official taxpayer-backed institutions from the write-down, the deal has created a distorted, two-tier bond market.” Основные цифры по сделке Breaking down the key figures Greek law bonds (Total €177bn) – voluntary participation 85.8% (€152bn) – with CACs 100% (€177bn) Foreign law bonds (Total €29bn) – voluntary participation 69% (€20bn) – CACs unknown (to be settled by 11 April) Total private sector involvement (PSI) participation so far – with CACs 95.6% (€197bn) Total level of nominal write-down achieved so far – €105.4bn (This is short of the €107bn assumed under the EU/IMF/ECB troika debt sustainability analysis, meaning that more foreign law bondholders will have to participate or not be repaid). Еще некоторые результаты Money needed to push PSI through - €93.7bn ‘PSI LM Facility’ (Bond sweeteners for private creditors) - €30 billion Bond Interest Facility (EFSF bonds to pay off accrued interest) - €5.7 billion Bank Recapitalisation Facility - €23 billion ECB Credit Enhancement Facility - €35 billion Under this scenario Greece is getting a €105.4bn write down, but taking on at least €58.7bn in new debt straight away. The EFSF, the eurozone bailout fund, is also taking on a further €35bn (by issuing additional bonds) to ensure Greek banks can still borrow from the ECB.[1] Что означает сделка для Греции и еврозоны Далее идет очень важная информация: What will this deal mean for Greece and the eurozone? - The debt write-down offered to Greece is far too small to allow Greece any chance of recovery. Of the total amount (€282.2bn) that is entailed in the various measures now on the table to save Greece – through the bailouts and the ECB – only €159.5bn, or 57% will actually go to Greece itself. The rest will go to banks and other bondholders.

Большая часть денег (43%), выделенных в виде разных мер помощи, пойдет банкам. - The use of CACs will almost certainly trigger the pay-out of Credit Default Swaps (CDS) in relation to Greek debt. Despite the opacity and secrecy surrounding the CDS market, there is little evidence to suggest that financial markets will be unable to cope with paying out on Greek CDS. Sellers of CDS have had plenty of time to prepare for this eventuality. Any who are not fully prepared or cannot bear the cost were likely taking irresponsible risks or have much deeper solvency problems.

- Greek banks have taken substantial losses. These banks will be recapitalised, but ‘only’ by €23bn. In contrast, to meet the 9% capital requirements set by the European Banking Authority, Greek banks could need between €36bn and €46bn. It is unclear if further money will be forthcoming, but valid questions will continue to be asked about state of Greek banks.

Греческие банки понесут значительные потери. Непонятно, будут ли они рекапитализированы в достаточной степени. - For the most part, Greek pension funds (which held around €30bn in Greek debt) have seen their assets reduced significantly. Some public sector pension funds did refuse to take part voluntarily. But they are likely to be forced to do so by the CACs. Importantly, it is unclear where Greek pension funds will recover their money from – the political fallout of having to cut pensions would only add to social unrest.

Греческие пенсионные фонды понесут значительные потери. - The Greek government’s threat to default on the remaining foreign law bonds – held by bondholders who have refused to take part in the voluntary restructuring, hoping to be paid out in full – seems credible. However, since most of Greek debt will now be in the form of new bonds and EU/ECB/IMF loans (which do not have cross default clauses related to the old foreign law bonds), Greece can default on these old bonds without being judged in default generally or on the rest of its debt.[2]

- The upcoming Greek elections at the end of April mean that the future of the second bailout package is still uncertain. The two main parties, New Democracy and Pasok, have been losing ground to both far-left and far-right parties. The hope is that these two leading parties will be able to form a coalition government with a clear majority in parliament. Even if they do not win the majority of votes, they may still have a majority of the seats due to the electoral structure in Greece. Even so, it will be a close run election and without a strong majority in parliament, every future vote on new austerity measures, of which there will be many, will be a hard fought battle – not conducive to political stability.

Выборы, которые состоятся в конце апреля, означают, что судьба второго пакета помощи все-еще неопределенна. - Under recent proposals, the total level of budget cuts Greece is expected to undergo stands at a massive 20% of GDP by 2013. Historically, no country has ever gone through such a large level of fiscal consolidation – successful or otherwise – especially without the option of currency devaluation. For example, the extensive fiscal consolidation seen in Ireland during the 1980s and 1990s totalled ‘only’ 10.6%.

Греции придется подвергнуть бюджетные расходы беспрецедентным сокращениям, аналогам которых нет в истории. Как это удастся без девальвации валюты – непонятно. - Athens is highly unlikely to meet its debt targets by 2020. This means that combined with the poor growth prospects due to continuous austerity, Greece will almost inevitably need either another bailout in three years’ time, or be forced to default on its outstanding debt.

В ближайшие три года Греции понадобится еще один пакет помощи - In parallel, the deal sets the eurozone up for a political row involving Triple-A countries. At the start of this year, 36% of Greece’s debt was held by taxpayer-backed institutions (ECB, IMF, EFSF). By 2015, following the voluntary restructuring and the second bailout, the share could increase to as much as 85%, meaning that Greece’s debt will be overwhelmingly owned by eurozone taxpayers – putting them at risk of large losses under a future default.

В начале этого года 36% греческого долга находилось в руках структур, находящихся на обеспечении налогоплательщиков. К 2015 году эта цифра может возрасти до 85%. - Therefore, this deal may have sown the seeds of a major political and economic crisis at the heart of Europe, which in the medium and long term further threatens the stability of the eurozone.

Эта сделка, возможно, посеяла зерна крупного политического и экономического кризиса в сердце Европы, который в среднесрочной и долгосрочной перспективе угрожает стабильности еврозоны. Greek PSI — the analyst reaction Греческий своп – реакция аналитиков Those new Greek bond yields... Несколько вопросов по поводу новых греческих свопов Goldman: "Greece Post PSI" Голдман о Греции после долгового свопа In either case, here is a summary of what Goldman sees happening next: "After the finalization of the PSI process, only small residual transactional uncertainty remains. The new Greece package ensures low funding costs that under certain assumptions could even be sustainable in the long term. Moreover, the exposure of the Greek private sector to the Greek government declines very substantially... ...while the exposure of the European official sector rises to substantial levels. Late-April elections will be a risk; but polls suggest a pro-EUR government is the most likely outcome. The new government will be tasked with creating a better growth environment. Голдман настроен позитивно: Using our GES score, we observe key areas of structural improvement for Greece’s growth environment... ...among others, the creation of a more business friendly environment, the establishment of conditions for increased openness to trade and a more effective rule of law." We will shortly present a far more realistic, and far less conflicted.

|