|

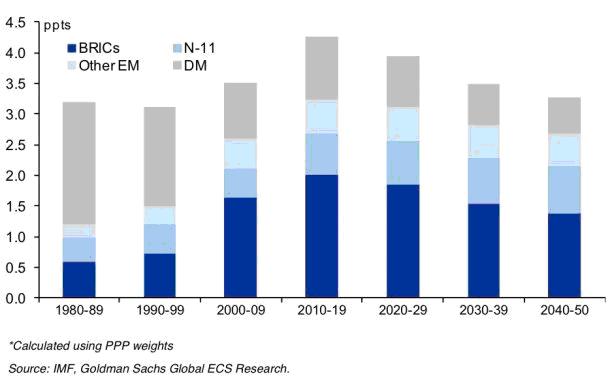

LINKS-ДАЙДЖЕСТ 21 марта 2012 г. Парламент Греции одобрил соглашение с ЕС и МВФ Греции дали 7,5 млрд евро кредитов Греция рапортует о снижении бюджетного дефицита Сахинидис назначен и.о. министра финансов Греции Бернанке и Гайтнер: экзамен со шпаргалкой Еврогруппу возглавит министр финансов Испании Делайте ваши ставки! Испания нашла выход из кризиса ЕЦБ: в еврозоне нет финансовых пузырей Правительство Германии продолжит сжимать бюджет В этом вопросе немцы и так остаются примером для окружающих: еще в середине прошлого года аналитики ждали дефицита по итогам всего 2011 г. на уровне 2% от ВВП, однако по итогам 12 месяцев стало известно, что дефицит составил всего 1%. Уже в 2014 г. планируется сократить дефицит до символического минуса в 0,35%, а к 2016 г. и вовсе выйти на сбалансированный бюджет. RWI: ВВП Германии в 2012 г. вырастет на 1% Британское правительство увязло в долгах По данным Национального статистического ведомства Великобритании, общий объем государственных заимствований правительства в настоящее время оценивается в 110 млрд фунтов. До конца текущего финансового года остается всего один месяц. По данным независимых аналитиков, за весь фингод уровень госзаймов составит порядка 127 млрд фунтов, однако, учитывая последние данные статистического ведомства, итоговые займы окажутся на 7 млрд фунтов меньше прогнозных значений. Доходность на облигации Португалии снизилась Barclays проверил банки ЕС по методу ФРС EFSF сузил ориентир доходности по выпуску бондов На фронте "валютных войн" грядут изменения Минфин: пора размещать евробонды РФ В 2011 г. Россия разместила рублевые еврооблигации на 90 млрд руб. Семилетние евробонды на 40 млрд руб. с доходностью 7,85% годовых размещены в феврале 2011 г., доразмещение этого выпуска на 50 млрд руб. проведено в мае. .................................................................................... теперь англоязычные Целая серия публикаций на BI оказалась посвящена тому, что американские бонды еще не стоят дешево, а следовательно акции будут расти. Прогнозы аналитиков становятся все более бычьими. По-моему это свидетельствует о том, что рынок находится вблизи вершин. GOLDMAN MAKES AN EPIC BULLISH CALL: Stocks Are A Better Buy Than At Anytime In A Generation Голдмановские аналитики вышли с эпическим прогнозом: сейчас лучшее время для покупок акций у представителей этого поколения?! Jim O'Neill: 'Who Cares About Greece?' Кого волнует эта Греция? Recently O'Neill said oil prices are his biggest concern not Greece. He reiterated the argument that China is creating an economy the size of Greece every 11.5 weeks, and asked: "Who cares about Greece?" Каждые 11.5 недель Китай создает такую экономику, как Греция. А вот с этого все началось: This morning Goldman portfolio strategists Peter Oppenheimer and Matthieu Walterspiler made a bullish case for U.S. equities saying stocks are much cheaper than bonds. Jim O'Neill told CNBC he has been bullish on U.S. equities for a while: "One is we have really low levels of bond yields, because many including policy makers do not believe things can ever return to normal. And the other one is we have people that don't believe that world growth can do better than it did at point x in the past. Being mister BRIC in reality despite western problems the world economy's growth rate is trending higher than it has been for 30 years of my existence. Put all of that together it is really bullish on equities." CHART OF THE DAY: This Is Going To Be A Peak Decade For Global Growth Голдманисты считают, что акции стоят дешево по сравнению с бондами. В долгосрочной перспективе, может, это правда... Но не в краткосрочной. And though you might think that things are slowing down around the world, Goldman argues just the opposite, that the 2010-2019 period has more growth potential than any decade between 1980 to 2050. Голдман считает, что период 2010-2019 годов имеет потенциал роста больший, чем любая декада с 1980 по 2050. Sure, developed markets aren't growing as fast as they used to be. And even the BRICs are slowing down. BUT, because the BRICs are so big now, and because the N-11 countries (Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, Turkey, South Korea, and Vietnam) are growing so fast, the net effect is that this decade could be a monster. Вот график фантазий будущего аналитиков Голдмана

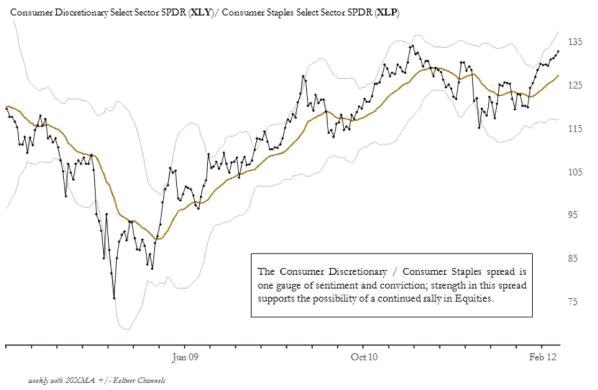

Откуда они знают, что будет в 2020-2050 годах? Линейная аппроксимация? Advice From The Federal Reserve: Bonds Still Aren’t Cheap Согласно прогнозу от Феда на ближайшие 5 лет, у казначейских бумаг сейчас очень низкая доходность. What Consumer Stocks Are Saying About The State Of The Stock Market Rally “Historically, the Discretionary/Staples spread has rallied with the broad market; in other words, it is not a leading indicator on rallies. However, it has also historically faltered before major indexes, making it a useful timing indicator and an early warning of trend failure. we see no weakness in this spread at this time.” Отношение динамики двух секторов Discretionary/Staples американского фондового рынка может служить предостерегающим сигналом близкого разворота.  Mortgage Applications Have Been Collapsing Again Обращения за ипотекой снова обвалились ........................................................................................... Deutsche Dumps Dodd - How Germany's Biggest Bank Ran Circles Around The Fed Как немецкие банки уходят из- под бдительного ока Феда. Why are we not surprised at the fact, as reported by the WSJ, that Deutsche Bank AG changed the legal structure of its huge U.S. subsidiary to shield it from new regulations that would have required the German bank to pump new capital into the U.S. arm. The bank on Feb. 1 reorganized its U.S. subsidiary, known as Taunus Corp., so that it is no longer classified as a 'bank-holding company' (BHC). The technical change has important consequences. 1001 Moonless Kinetic Nights: Presenting The Windows Of Opportunity For An Iranian Attack Анализируется, когда Израилю наиболее удобно по времени нанести удар по Ирану Based on press reports, officials see high odds of an attack sometime between 2Q12 and the end of the year, with most pointing to 2Q or 3Q. If Israel elects to conduct a conventional military strike, the optimal conditions would be moonless and cloudless nights. “Operation Orchard,” Israel’s attack on Syria’s reactor at Al-Kibar on Sep 6, 2007, took place 5 days before the new moon. This suggests windows starting about 5 days before a new moon and ending five days after - see the table below. Low humidity is also ideal, but not required.

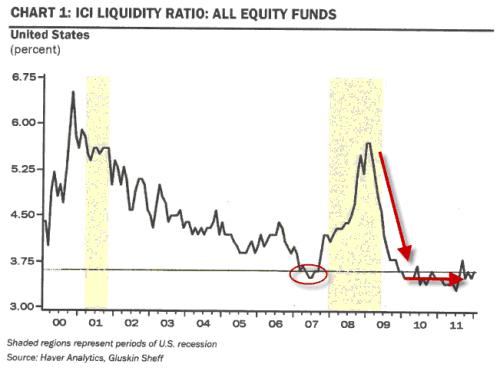

Forget Barton Biggs, David Rosenberg Has The Truth On Sideline Cash Дэвид Розенберг свидетельствует, что кэш находится вблизи минимальных уровней. However, as Rosie points out equity fund cash ratios are at a de minimus 3.6%, the same level as in the fall of 2007 and near its lowest level ever. The time when cash was heavy and 'ample' was at the market lows in 2009 when the ratio was very close to 6%. Bond fund managers, it should be noted this includes the exuberant HY funds, are now sitting on less than 2% cash so if retail inflows continue to subside as they did this week, buying power could weaken over the near-term.  Treasuries Surge Leaving Equities Running On Fumes О том, как торговались в этот день разные активы Treja Vu: Albert Edwards Expects New Lows On Bond Yields, Equity Rally Turning To Dust, "Just As It Did In 2011" Albert Edwards из SocGen ожидает, что ралли в акциях скоро выдохнется и мы еще увидим новые минимумы доходности US Treasuries в этом году. Albert Edwards explains: 'With bond yields breaking out to the upside and the equity bull run continuing, investors are back to their same old hopeful habits. Many are thinking that if we have seen the all-time lows on bond yields investors will be forced into equities. We already can observe leading indicators rolling downwards in exactly the same way as they did in 2011." And here is why Edwards will once again be unpopular with the permabull, momentum chasing crowd: "Expect new lows on bond yields by Q3 and this equity rally to turn to dust – just as it did in 2011." European Sovereign Debt Shows First Weakness In 3 Months Ситуация в европейских суверенных долгах начинает разворачиваться в худшую сторону. Whether it was the truthiness of Willem Buiter's comments this morning, the sad reality of Spanish housing, or more likely the ugly fact that LTRO3 is not coming (as money-good assets evaporate), today was broadly the worst day of the year for European sovereigns. Spanish 10Y spreads jumped their most since the first day of the year, Italian yields broke back above 5% (and spreads broke back over 300bps), and Belgium, France and Austria all leaked notably wider. Since Friday's close, Italian and Spanish bonds have suffered their largest 2-day losses in over 3 months. Notably the CDS markets rolled their contracts into Monday and perhaps this derisking is real money exiting as they unwound their hedges - or more simply profit-taking on front-run LTRO carry trades but notably the LTRO Stigma has exploded in the last few days back to near its highs. European equity markets are now underperforming credit - having ridden the high-beta wave far above credit markets in the last few months (a picture we have seen in the US in Q2 2011 and HY is signaling risk-aversion rising in the US currently in the same way). Just how will the world react to another risk flare in Europe now that supposedly everything is solved? A Few Quick Reminders Why NOTHING Has Been Fixed In Europe (And Why LTRO 3 Is Not Coming) Несколько коротких напоминаний, почему еще в Европе не наступила стабильность и почему LTRO 3 не придет European Housing Still Slumping Рынок недвижимости Ирландии/Испании не подпадает под категорию «слабый». Он хуже. After a disappointing home sales print in the US (as the shadow overhang remains heavy), some perspective on just how bad it is in Europe is worthwhile. With Spanish yields starting to blow out again, it likely comes as no surprise that, as Goldman notes, the Spanish housing market (and for that matter the periphery in general) is bad and getting worse. However, Ireland remains the worst of the worst and Goldman sees yet another growing divide between the haves and have-nots of Europe as the residential property price performance can essentially be split into four groups: Strong, Recovering, Weak, and Ireland/Spain; with the latter perceived as considerably worse than the 'reported' data would suggest. Is it any wonder that Spain trades wide of Italy again now and as Citi's Buiter noted earlier, Spain is now the fulcrum market (Spanish 10Y spreads +30bps from Friday's tights). Howard Marks: "Common Sense Is Not Common" Здравый смысл – это не то, что свойственно большинству. As usual, Oaktree's Howard Marks cuts to the chase in his latest memo. Much as we just discussed the seeming complacency and drop in risk perception that currently exists, Marks scoffs at the 'It's Different This Time'-argument noting "there’s sure to be another cycle, another bubble and another crisis. There’ll be another time when people overpay for exciting investment ideas because their future appears limitless, and then a time of disillusionment and price collapse. There’ll be another period when leverage is embraced to excess, and then, consequently, a period when it gets people killed. And there’ll certainly be another time when people can only imagine the possibility of gain, and then one when – after huge sums have been lost – they can think only of further declines." Touching on the extremes of dysphoria and complacency that summarize the herd of global investors, he nails the reality of the crowd: "common sense isn’t common. The crowd is invariably wrong at the extremes. In the investing world, everything that’s intuitively obvious is questionable and everything that’s important is counter-intuitive." Будет новый цикл, новый пузырь и новый кризис. Толпа неизменно неправа на экстремумах рынка. ........................................................................................... Следующие несколько статей посвящены превью рассмотрения бюджета Великобритании Budget Gloss Can't Hide UK Vulnerability (Investics) U.K. Deficit Widens Beyond Expectations In February, Posen And Miles Insist On More Stimuli Дефицит бюджета в феврале вырос больше ожиданий. Позен и Майлс настаивают на большем стимулировании экономики What To Expect From The UK Budget Что ожидать от рассмотрения бюджета Preview: China HSBC Manufacturing PMI – Key To Commodity And Risk Outlook В четверг в 6.30 по Москве выйдет индекс деловой активности в производственном секторе Китая, рассчитываемый банком HSBC – ключ к дальнейшему движению цен на commodities и риску в целом. Главный китайский фондовый индекс Shanghai Composite и цены на медь уже отражают опасения инвесторов относительно роста китайской экономики. Chinese Stocks and Copper Reflect This Pressure China's main index – the Shanghai Composite – already reflects concerns about China's growth as it has topped off in early March, and begun declining. Copper – a key commodity in the production process similarly reflects this pressure as it trades in a range throughout February and March unable to push above a recent downward sloping resistance trendline and horizontal resistance at 3.9450.

|