|

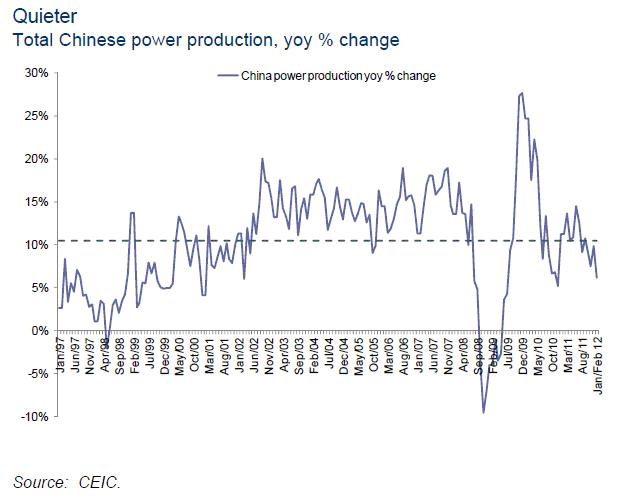

LINKS-ДАЙДЖЕСТ 29 марта 2012 г. Это ДАЙДЖЕСТ ссылок на аналитические материалы, главным образом англоязычные. Италия продала облигации на 8 млрд евро Бернанке: QE не влияет на волатильность ЕС пойдет навстречу рейтинговым агентствам Риски на ипотечном рынке Испании возрастают .................................................................................... теперь англоязычные PRESENTING: The 10 Ominous Signs That Will Portend Another Spring Stock Market Sell-Off Сценарий этого года повторяет сценарии двух прошлых лет "In each of the past two years the stock market began a slide in the spring, a phenomenon often referred to by the old adage 'sell in May and go away,' which lasted well into the summer months," wrote LPL Financial's Jeff Kleintop in his latest weekly market commentary. The pattern is almost eerily similar. "In both 2010 and 2011 an early run-up in the stock market, similar to this year, pushed stocks up about 10% for the year by mid-April. On April 23, 2010 and April 29, 2011, the S&P 500 made peaks that were followed by 16 – 19% losses that were not recouped for more than five months." We still have a few weeks before the end of April. But until then, Kleintop is carefully watching 10 indicators that turned ahead of the sell-off. ........................................................................................... Greek Deposit Run Update: Hopeless And Getting Worse Бегство депозитов из Греции продолжается Paul Mylchreest Presents Various Visual Case Studies Of Gold Price Manipulation О манипуляциях золотом European Weakness Spreads And Accelerates Европейские рынки активно распродаются European equity prices fell for the third day in a row and pulled back near six week lows, breaking below the 50DMA for the first time since it crossed above on 1/16. Today's drop was the largest in three weeks as Italian banks were halted, plunging their most in over three months and back at levels not seen since mid January. Most Italian banks are down 9-11% in March but BMPS is down over 24% as Italian sovereign yields start to come unhinged again (ironically a day after Monti announced the crisis was over). 10Y BTPs broke back below last Friday's lows (the moment the ECB stepped in last time to save the day) up over 5.2% yield - catching up to CDS levels (and ITA spreads are +23bps on the week). Spain is also weak (+15bps on the week) and heading for 3 month highs in its yields. Since the CDS roll (March 20th), the sell-off has accelerated with equity and credit markets tracking lower together (as opposed to the last few months where credit underperforms and then snaps back higher). We discussed the LTRO Stigma trade earlier and that has continued sliding notably wider today as LTRO-encumbered banks hugely underperform. We suspect hedges (sovereign credit, financial credit, and equity) placed early in the year for the 3/20 Greece event (among other things) have run off and now managers are reducing risk in real terms (selling) as opposed to replacing hedges which is why the uber-supported markets of Italy and Spain are losing the battle now. Lastly, Europe's VIX is its richest relative to US VIX since the rally began, jumping dramatically today. 1987 Redux Or Sweet Serenity Нынешний год – маленькое подобие 1987 года. Тогда тоже все хорошо начиналось, а закончилось биржевым крахом The last time the S&P 500 rallied in such a serene manner as the current trend was March 1987 - a few months before monetary imbalances came undone and crashed in October 1987. Further, JPMorgan's Michael Cembalest notes that prior to WWII, the previous rally as calm and uninterrupted as this was in November 1928 - a year before the crash. $29 Billion 7 Year Bond Sold In Uneventful Auction, Indirects Take Most Since August Как прошел аукцион по размещению 7-year bonds Unlike yesterday's 5 year bond auction, which priced at the lowest Bid To Cover since August, there were no major surprises during the just concluded issuance of $29 billion in 7 Year bonds. The closing high yield was 1.59%, just as the When Issued predicted, which is the highest rate since October. The internals were more or less inline - Indirect takedown of 42.79% was the highest since August's 51.72%, Directs decline modestly from February's soaring 19.27%, to just 13.40%, which still was quite a bit higher than the TTM average 12.23%. Dealers were left with 43.81% of the auction, about 3% below their average. And while the market was sensing a weak auction ahead of the pricing, the subsequent favorable response in the Treasury complex has sent the entire curve tighter again, and money flowing out of stocks, which had hit an intraday high just before the auction completion. In other news, total US debt is now over $15.6 trillion. Which Is The True Jobless Rate Correlation? Charting The Schrödinger Unemployment Rate Какова истинная корреляция безработицы No, It Is Not Just The Chinese New Year Темпы роста потребления электроэнергии в Китае падают и это о многом говорит....  On Liquidity And The False Recovery Видео, которое Zero Hedge рекомендует обязательно посмотреть David McWilliams (of Punk Economics) is back (previous discussions here and here) and this time he takes on the the flood of liquidity and the false recovery that has been created. Starting with a discussion of gas prices and the central banks' recklessness behind it, he swiftly shifts to the 'shambles in Greece' where more debt is supposed to solve the problem of too much debt yet again. From extreme highs in Greek rates to extreme lows in rates among the major developed economies he juggles with the conundrum of injecting liquidity to reflate a bubble in order to avoid the consequences of the bursting of a bubble - brilliant (as those Guinness chaps would say) - as this merely pushes the next crash out a few more years but making it bigger and more devastating. Global Central banks have pumped $8.7tn into the banking system to 'save the world'. Saving the banks has cost more money than it cost to fight WWII, the first Gulf War, put a man on the moon, clean up after last year's Japanese Tsunami, and the entire African aid budget for the last 20 years all put together. Context is key - is it any wonder asset prices have risen since there has been so much cash looking for a new home - why hold something that is printed everyday (cash) when you can hold something that is actually running out like oil or gold. The punchline is what goes in must come out - and that means inflation - as the 'trip' of excess liquidity comes home to roost. Must watch. ........................................................................................... Eurogroup Preview: Firewall to be doubled in Copenhagen Превью встречи еврогруппы в Копенгагене What's Next For The Japanese Economy And The Yen? Что будет дальше с японской экономикой и йеной

|