|

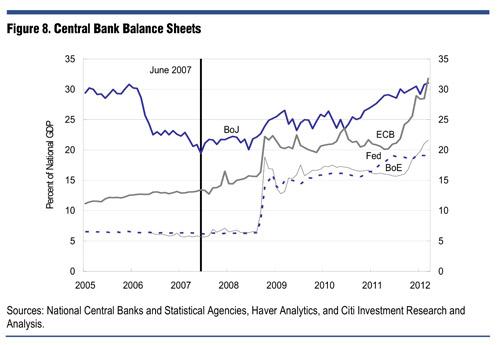

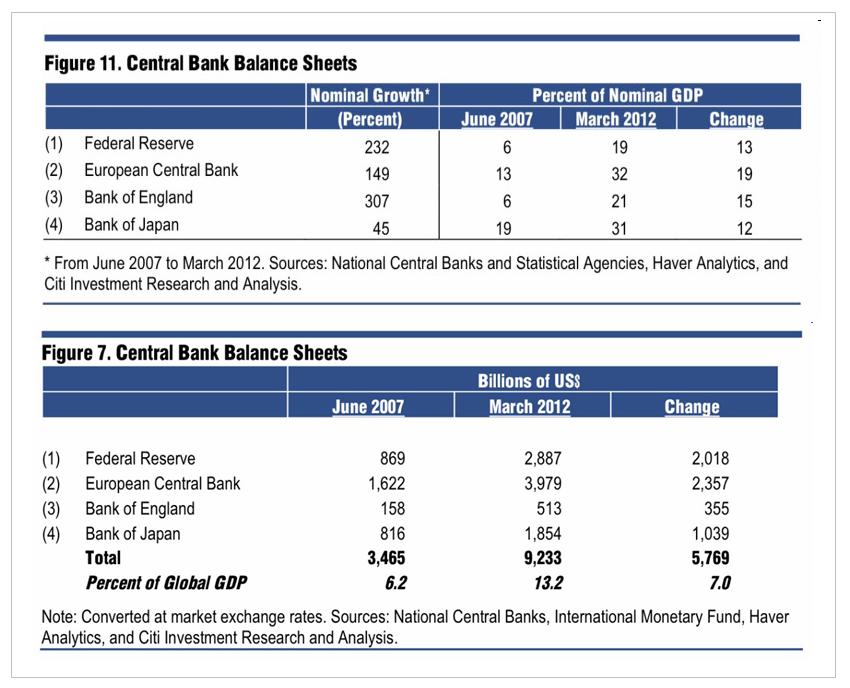

LINKS-ДАЙДЖЕСТ 25 марта 2012 г. Это ДАЙДЖЕСТ ссылок на аналитические материалы, главным образом англоязычные. теперь англоязычные JPMORGAN: 5 Reasons To Stay BullishJPM о пяти причинах, чтобы оставаться быками Things That Make You Go Hmmm... Such As A "Fiscally Credible" UK And Its Upcoming 100 Year Gilts Обсуждается идея британского министра финансов выпустить 100-летние бонды (UK Daily Telegraph): Britain is to offer 100-year gilts, meaning current Government borrowing will not be repaid until the next century, ... The Chancellor hopes that the 100-year gilts will help to “lock in” the benefits of Britain’s international “safe haven” status. The interest rates paid by the Government to borrow money have recently fallen to a record low and it is hoped the new gilts will mean “our great-grandchildren” can benefit from the low rates. Currently, the average duration of the Government’s £1 trillion debt is around 14 years – with maturities ranging from months to a 50-year bond issued in 2005. Longer-dated debt is widely thought to offer a country more stability. A Treasury source said tonight: “This is about locking in for the future the tangible benefits of the safe haven status we have today. The prize is lower debt interest repayments for decades to come. “It is a chance for our great-grandchildren to pay less than they otherwise would have done because of the government’s fiscal credibility.” Национальной ассоциации пенсионных фондов не нравится эта идея (FT): The National Association of Pension Funds on Wednesday criticised the chancellor’s plans for an “Osborne bond” – a 100-year debt issue or even a perpetual gilt that never matures – saying it would prefer shorter maturity debt that was protected against inflation. One senior UK fund manager said: “This could be of interest for pension funds as it would be a good match for their liabilities.” But another said: “We would not be buyers of this debt because the yields are too low. It would be great for the government and the British taxpayer, but I don’t think we would want to lock in yields so low for such a long time. Yields are artificially low because of the Bank of England’s quantitative easing initiative.” Инфляция съест эти инвестиции From the Government’s point of view it was a masterstroke which transformed the public finances, but it was a disaster for investors. The new stock immediately plunged in value, yet the real damage was to come later from the value destructive effects of inflation. £1,000 invested in the War Loan back then would in today’s money be worth less than £20. Previewing Next Week's Events Goldman представляет события следующей недели In terms of US activity data, the focus will be on the Chicago PMI, Durable Goods and Personal Income. Though we do expect a technical rebound in the durable good orders after the weakness in the previous report, we think the Chicago PMI could slip by more (to 60 from 64) than consensus expects. Overall, the message from US activity data may therefore remain mixed outside the still-strong labour market data. In terms of Asian activity data, the end of the week will be important. The official China PMI for March will be interesting after the weakness in the Flash PMI. Korean trade is the first non-survey based activity indicator published globally that is published for the previous month. Both are due next Sunday. по поводу валютного рынка In terms of FX markets, we will remain quite focused on the Yen, partly because of our recommendation and partly because of the fiscal year-end in Japan and related possible last-minute volatility. The IP number for February could be important as the main data release for Japan in the upcoming week. Given the focus on rate differentials for $/JPY, but also more broadly for the Dollar, three speeches by Chairman Bernanke on Monday, Tuesday, and Thursday could be relevant. The upcoming week is very heavy on Fed speeches with at least one scheduled every day. The First Crack: $270 Billion In Student Loans Are At Least 30 Days Delinquent 270 млрд. долларов в студенческих займах имеют задержку в погашениях более 30 дней. Yet one bubble which the Federal Government managed to blow in the meantime to staggering proportions in virtually no time, for no other reason than to give the impression of consumer releveraging, was the student debt bubble, which at last check just surpassed $1 trillion, and is growing at $40-50 billion each month. However, just like subprime, the first cracks have now appeared. In a report set to convince borrowers that Student Loan ABS are still safe - of course they are - they are backed by all taxpayers after all in the form of the Family Federal Education Program - Fitch discloses something rather troubling, namely that of the $1 trillion + in student debt outstanding, "as many as 27% of all student loan borrowers are more than 30 days past due." In other words at least $270 billion in student loans are no longer current (extrapolating the delinquency rate into the total loans outstanding). That this is happening with interest rates at record lows is quite stunning and a loud wake up call that it is not rates that determine affordability and sustainability: it is general economic conditions, deplorable as they may be, which have made the popping of the student loan bubble inevitable. The Fed Is Losing The "Race To Debase" В гонке по девальвации валют (баланс/ВВП) Фед неожиданно оказался на последнем месте. На первом месте теперь ЕЦБ, который опережает даже BOJ As the following chart from Willem Buiter shows, in its fake attempt to show monetary restraint, the Fed has gone straight into last place in the "race to debase." Needless to say, in a world with $25+trillion in "excess" debt (debt which would need to be eliminated simply to reduce global debt/GDP to a "sustainable" 180% per BCG), last is a very bad place to be...

|