|

LINKS-ДАЙДЖЕСТ 23 марта 2012 г. LINKS-ДАЙДЖЕСТ, El-Erian, Doug Kass, ECB bonds buying, assets/GDP, interest payments/GDP, government debt/revenue, home sales, Tchir, SNB Драги: грекам нужны реформы Доходность бондов Греции за день взлетела выше 20% Британский ЦБ: время срочно запасаться капиталом Розничные продажи в Италии начали расти Бизнес во Франции постепенно оживает Приток капитала на фондовый рынок РФ продолжается Испания сэкономит еще 35 млрд евро в 2012-13 гг. Deutsche Bank: финансы Европы по уши в кризисе ФРС пресечет попытки обойти требования к капиталу Разногласия в ФРС нарастают Кто выиграет от замедления Китая .................................................................................... теперь англоязычные EL-ERIAN: The Economy Is Improving, But It Isn't Ready For The Fiscal Cliff Структурные проблемы предстоит еще решать, а экономике восстанавливаться после приема «чрезвычайных медицинских средств». In his latest note published in Project Syndicate, El-Erian says there are structural problems that need to be addressed. He cautions against complacency and says the economy needs to recover from the "extreme medicine it received" i.e. fiscal stimulus and other policies enacted by the Fed: DOUG KASS: Goldman's Big Bullish Bet Is Just Plain Wrong Doug Kass считает, что призыв покупать акции со стороны GS свидетельствует о том, что рынок достиг локального максимума. Earlier this week, Goldman portfolio strategists Peter Oppenheimer and Matthieu Walterspiler wrote that "the prospects for future returns in equities relative to bonds are as good as they have been in a generation," in a long-term bullish call that shocked even some of the most optimistic investors. But legendary value investor Doug Kass isn't having any of it. He goes so far as to exclaim, "I can't help but think that Goldman Sachs might have rung the bell that the market has topped in the near term!" in an editorial published by The Street today. ........................................................................................... Is The ECB BTP Buying Spree Back? Кажется, что ЕЦБ возобновил покупки BTP (итальянские долговые бумаги) Не с этим ли связан рост EURO ? 3 Charts On Why Eurosis Never Really Went Away Три графика, которые показывают, что еврокризис никогда не закончится

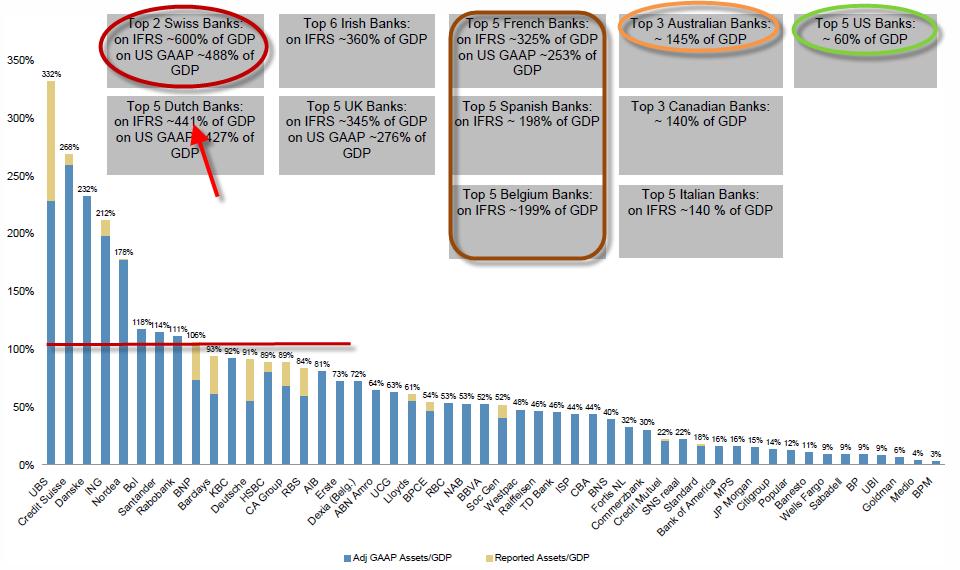

If ever there were banks that were truly Too-Big-Too-Fail, Europe has them - is it any wonder the Greek Bailout was so focused on rescuing the bank balance sheets. Swiss banks dominate the worst end of the spectrum along with Dutch banks (huge covered bond markets) but the French, Spanish, and Belgian banks are all around two times their nations GDP! Of course this assumes the asset values are 'correctly priced' and not some non-MtM dream and while they are deleveraging (which itself causes aggregate credit supply issues for the real economy and overhangs for the financial economy), LTRO has done nothing but slow the efforts in a false-sense-of-security way. We could add a bonus chart here on European bank reliance of ECB funding - that shows Italy and Spain nearing Portugal's level of aggregate reliance - not exactly a resounding success. Отношение процентных платежей к производственным доходам экономики быстро растет.

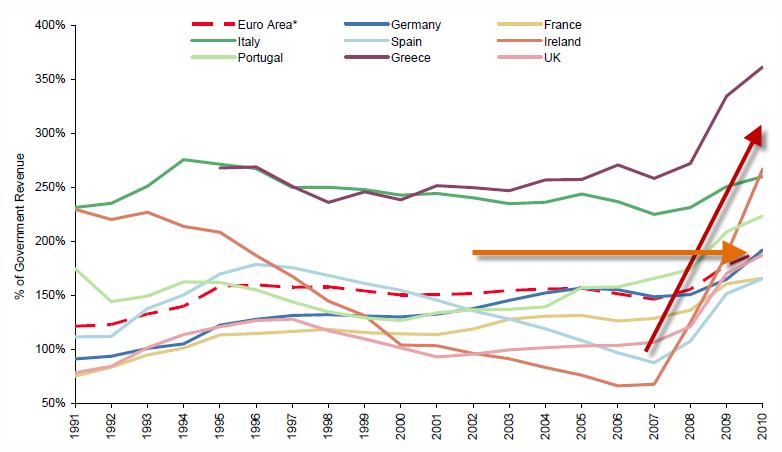

Perhaps the cleanest measure of 'stress' or service-ability for the currency-using sovereigns shows that the amount European sovereigns pay in interest relative to their productive gains as an economy is rising rapidly and forecast to rise even faster. This will obviously get worse as the recession deepens from both rising costs (as post-LTRO rate normalize) and lower GDP (as austerity and balance sheet recession impacts come home to roost). Левередж находится на 20-летних максимумах.

The 'leverage' of the Euro-Area has never been higher. Across every nation, we are at over 20 year highs in terms of this measure of leverage. To impact this via the fiscal compact by raising taxes and deleveraging at the aggregate level can only exaggerate the recessionary pressure Europeans will feel. While yields have indeed dropped, the reflexive response that ergo - Europe is fixed - is simply nonsense as nothing has changed and in fact the concentration and contagion stress is worse than it ever was. This time may be different as this time, the ECB is really in a box to fix the next risk flare without outright money-printing and Zee Germans vill not like zat! Eurosis Is Back As "New" Greek Bonds Break 20%, Slide 14% In 2 Days Новые греческие бонды драматически упали за последние два дня. Well that didn't take long. New Greek bonds (GGB2) have dropped dramatically in the last 2 days. The 2023 bond has fallen from over EUR29.5 on Wednesday to under EUR25.5 this morning, prices have dropped an incredible 14% and down a painful 17.5% from its opening break highs of just 2 weeks ago. Yields have broken back above 20% for the first time for this new 10Y as it appears reality is sinking in that Greek Bailout III will come sooner rather than later. Eurosis is back. Spanish Bond Yields - Who's A "Natural" Buyer Of The 10 Year Peter Tchir Кто покупает 10-летние испанские бумаги? So the reality is, the only banks that might buy long dated Spanish bonds are Spanish banks, and they are already pretty full of Spanish debt and even they much prefer to buy the short end. In theory, that special little subset of Spanish banks, the Caja’s, might do as they are told, but since they are already on life support, that is hardly a deep pocket investor. Испанские банки и другие финансовые организации, и они уже под завязку загрузились испанским долгом Banks always tended to buy 5 year and in. 10 year bond never fit banks as well as shorter dated bonds, so they were never the core buyer of this part of the curve. This desire to be in shorter maturities has been accentuated by the LTRO. LTRO encourages banks to buy 3 year and in paper for 2 reasons – i) no funding mismatch at maturity of LTRO, and ii) since LTRO is collateralized, far less risk of having to post variation margin on short duration bonds (at least until the whole curve inverts). So banks across the board have many incentives to participate in the short end which was their natural tendency to begin with. So banks as a whole do not like the long end, and foreign banks will dislike it even more. It is very hard for a non-Spanish bank to justify long term positions in Spain. There is $100 billion of debt in the Spanish system where banks issued bonds to themselves, got it guaranteed by Spain, and are using those bonds to get central bank money. As a non-Spanish bank, you have to look at that cozy relationship and be nervous. If, and when, the Spanish financials deteriorate, it is hard to expect fair treatment as a foreign bank when it is so clear that Spanish banks and the government have become very interconnected. Иностранцам покупать долгосрочный долг Испании очень рискованно. Officials can talk about the low debt to GDP in Spain, but professional investors have to look at all the contingent and hidden debt. Spain has implicitly and explicitly guaranteed the municipal debt. The Spanish government is in up to its eyeballs in helping the Caja’s. They have participated in the LTRO ponzi bond scheme even more than Italy has on a relative basis. These contingent liabilities will make insurance companies more reluctant, but that would still be part of the “fundamental” analysis. There are relatively few natural buyers of Spanish long dated bonds here. Fast money is likely caught long, and it will take a potentially reluctant ECB and some already overly exposed Spanish institutions to step up and stop the slide. It may happen, but many of the policies that “bailed out” Greece created very bad precedents for bondholders, and some of those are coming home to roost, as is the understanding that LTRO ensures that banks can access liquidity, but does nothing to fix any problem at the sovereign level. Guest Post: About That $20 Trillion In Public Debt... За 3 последних года публичный долг США был увеличен на 20 трлн. долларов и нет никакого быстрого роста ВВП. In only three more years you're talking $20 trillion in public debt for the USA and a GDP going nowhere fast. Add to this that demographics are not encouraging and taxes of all sorts will have to rise. Cuts will be symbolic because the political pain will be unbearable. Without productive new investment, then debt service soon outstrips income growth and the economy enters a death spiral of declining productive investment, ever expanding debt and ever higher debt service costs. Как он будет обслуживаться в быстроменяющейся экономической обстановке? Please Highlight The Housing Recovery On The Following Chart Восстановление американского рынка недвижимости очень наглядно

Продажи домов на одну семью на абсолютном минимуме. ........................................................................................... SNB Quarterly Bulletin Released Опубликован Бюллетень Центрального Банка Швейцарии We would like to note, there is a slightly optimistic tone in the report. As risks have remained marginally unchanged, the bulletin notes improvements in the financial markets and mixed developments on the global growth front. While the SNB still views the overvalued CHF as a "challenge to the economy", they mentioned "growing indications that Switzerland's economy is stabilizing." The SNB goes on to state that the minimum exchange rate has reduced volatility and allowed businesses to plan with greater certainty. "For 2012, the forecast shows an inflation rate of -0.6%. For 2013, the SNB is expecting inflation of 0.3% and for 2014, of 0.6%". While the 2012 inflation path was adjusted downwards, from Dec 2011 forecast, it still represents a trough. Heading progressively higher in Q2 2012 saying "SNB expects the CPI to move over the next three years". Interestingly, the SNB forecast assumptions are based on Brent at $110 and EURUSD at 1.29. It's looking highly unlikely that a shift in the minimal exchange rate is coming anytime soon, but this report will clearly reignite debates on the likely timing of the exit. We are currently seeing CHF appreciation against both the USD and EUR. ........................................................................................... BOE Weale: Sees Positive, Better-Than-Expected Q1 GrowthЧлен MPC при банке Англии считает, что повышение ставки BOE произойдет раньше, чем многие этого ожидают. The MPC member, who voted against further quantitative easing at the March meeting and has warned that a rate hike could come sooner than markets have been pricing in, said that the quarterly growth pattern would be choppy this year, with the Queen’s Jubilee and the Olympics clouding the picture. After contracting in the fourth quarter of 2011 the economy, however, appears on track to avoid a technical recession. A little something for the finance ministers На следующей неделе будет обсуждаться будущее фондов EFSF и ESM The European Commission has published a short paper outlining three options for the eurozone rescue programme, ahead of eurozone and EU finance ministers’ meetings next week. But... Germany wants to avoid anything that requires parliamentary approval and is extremely unlikely to go with this to the Bundestag. Which leaves option 2, in which the two funds run concurrently until mid-2013, which would make €740bn available — but only until next year. That, the EC says, might be enough to persuade the G20 etc. The Yen's Looming Day of Reckoning Большая статья про японскую экономику Соединение слабой экономики и сильной валюты – это очень странная вещь. The combination of a weak economy and strong currency are always suspect. But it has lasted for so long that even foreigners take it for granted. I think this is some sort of mass hysteria. Most people only remember a strong yen. On the other hand, most people haven't seen rising property or stock markets either. Сильная йена – это психологический феномен. Japanese culture is group-oriented. Individuals usually embrace group activities. This psyche was the reason that Japan's property bubble became so big in the 1980s. In terms of value above the normal level, Japan's bubble was five to six times the size of the bubble in the United States. After the property bubble, the group psyche shifted its power to a strong yen, pushing Japan's economy onto the path of a rising yen, deflation and rising government debt. Japan's paralyzed political system is the reason the government has accommodated the deflation path by running up national debt. The Japanese people, on the other hand, buy the debt because deflation makes property or stocks bad investments and a strong yen discourages them from buying foreign assets and deflation. Despite the fact Japan has had a bad economy for so long, the yen has remained strong. It reinforces the Japanese psyche on the issue. The strong yen has become a cult.

|