|

LINKS-ДАЙДЖЕСТ 28 марта 2012 г. Япония не может определиться с налогами Монетарная политика в Японии останется мягкой Бернанке: праздновать победу пока рано Италия продала 6-месячные векселя на 8,5 млрд евро Инфляция в Германии замедляется Испании потребуется финансовая помощь Монти: "Самая страшная стадия кризиса позади" Аукционы ЕЦБ дали осечку Европейские банки используют средства ЕЦБ на скупку облигаций, а не на кредитование. В феврале объем кредитования нефинансовым компаниям снизился на 3 млрд евро против роста на 1 млрд евро в январе. В то же время денежная масса зоны евро увеличилась на 2,8% в феврале по сравнению с январским ростом в 2,5%. В то же время банки Италии и Испании нарастили покупки гособлигаций. Так, итальянские финансовые организации увеличили объем своих вложений на рекордные 23 млрд евро. Это довело их общий объем участия в этом рынке до 301,6 млрд евро. Испанцы в свою очередь отошли от январского рекорда в 23 млрд евро. В феврале они потратили на госбумаги 15,7 млрд евро. Их вложения в облигации еврозоны оцениваются в 245,8 млрд евро. .................................................................................... теперь англоязычные Why Tomorrow's GDP Report Could Be WAY Better Than Anyone Expects Nomura ожидает, что завтрашний финальный ВВП окажется лучше ожиданий ........................................................................................... EU - EFSF & ESM - A Whole Lot Of Nothing Peter Tchir US Issues New 5 Year Bonds At Lowest Bid To Cover Since August, Sends Total US Debt Over $15.6 trillion Как прошел аукцион по 5-тилетним US notes Today's $35 billion 5 Year auction was not very pretty: coming at a high yield of 1.04%, it was a tail to the When Issued trading 1.03% at 1pm, and the highest rate since October's 1.055%, and the first 1%+ print in 2012. Also notable was the drop in the Bid To Cover to 2.85, which in turn was the lowest since the 2.71 in August of last year. Aside from that the internals were in line: Directs took down 11.3%, in line with the 11.4% average, Indiricts 41.9%, just below the 42.8% TTM average, and the remainder was Dealers, whose 46.8% allocation was just slightly lower than the 45.8% they have taken down previously. All in all another auction that squeezed by courtesy of the PD syndicate, which as has been noted before, is already loaded to the gills with the short-term bonds that Uncle Ben is selling. More importantly, this is the auction that in conjunction with tomorrow's last of three, will send total US debt higher by another $39 billion and brings it to a fresh record high $15.6 trillion. There is now about $700 billion in debt issuance capacity before the debt ceiling is breached again. At this run rate, this is just under 6 months before the debt ceiling scandal ramp up again, or just in time to be used by the GOP as the biggest trump card in the Obama reelection debates, just as we suggested here first back in February. ZH считает, что новый лимит госдолга наступит через 6 месяцев Europe Leaks It Will Fix Crushing Debt Problem With €940 Billion Of More EFSFESM Debt Утечка: общий фонд EFSF/ESM хотят увеличить до 940 млрд. EURO Europe Drops Most In 3 Weeks As LTRO Stigma Hits New Highs European equities dropped their most in almost three weeks over the last two days closing right at their 50DMA (the closest to a cross since 12/20). Credit markets (dominated by financial weakness) continue to slide as the LTRO euphoria wears off. The LTRO Stigma, the spread between LTRO-encumbered and non-LTRO-encumbered banks, has exploded to over 107bps (from under 50bps at its best in mid Feb when we first highlighted it) and is now up over 75% since the CDS roll as only non-LTRO banks have seen any improvement in the last week. Goldman On Europe: "Risk Of 'Financial Fires' Is Spreading" ESM не сможет произвести столь положительный эффект, как LTRO. The Euro area is a financially closed region, with more than 85% of sovereign bonds held by residents of the area. If we add to this the fact that most claims against governments are held by financial institutions domiciled in the area, the risk of ‘financial fires’ spreading is high. The prevailing policy view that bigger ‘firewalls’ would make investors more comfortable about purchasing sovereign bonds of EMU countries. This is predicated on the idea that the existence of a funding backstop would prevent credit shocks in one of the EMU members from spreading to other issuers. That said, we doubt the current infrastructure can produce the same effects on markets as the ECB’s long-term liquidity injections (LTROs). Our view is based on the following considerations. - Size: Even if we combine the full uncommitted capacity of the EFSF and the ESM (EUR700bn), the total would not be sufficient to backstop the bigger markets of Spain and Italy. The former’s borrowing requirement (amortization plus deficit) over the next two years is EUR305bn, while the latter’s amounts to EUR525bn.

- Seniority: The ESM holds ‘preferred creditor status’ over existing bondholders (art.13 of the Treaty establishing the ESM). In practice, this means that if the facility is used to provide an EMU member country under conditionality, it would subordinate existing bondholders (twice, if the IMF also participates in a bailout). Given that investors are aware of this, they would require compensation to bear such risk. This could exacerbate, rather than mitigate, a crisis.

- Governance: The existing vehicles cannot intervene pre-emptively in markets at signs of tension. Rather, they would be activated only after a full crisis has erupted. The procedure envisages that the ECB would ring an alarm bell should tensions threaten the stability of the Euro area. The sovereigns experiencing tensions would need to formally ask for help, and sign a memorandum of understanding, before any financial support can provided. Admittedly, a ‘fast track’ option is also available, based on ‘light conditionality’ and allowing the EFSF to intervene in secondary markets. Still, the fixed size of resources could raise questions on the effectiveness of the operations.

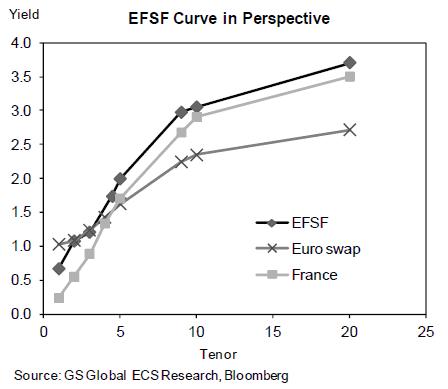

Кривая доходностей EFSF в перспективе  As The ECB Crosses The Inflationary Rubicon Has Mario Draghi Lost All Control? Потерял ли Марио Драги контроль над ситуацией с того момента, как ЕЦБ перешел Рубикон Durable Goods Miss, Inventory Stockpiles Soar To New All Time High Результаты статистики по заказам на товары длительного пользования и запасам не оправдали ожиданий ........................................................................................... Bank Lending Key For Recovery And EUR Банковские кредиты и М3 – эти экономические параметры имеют для еврозоны особое значение AUD - Breakdown in Chinese Equities Pressures Aussie Crosses Провал на китайском рынке акций давит на кросскурсы AUD We have been monitoring Chinese equities for clues as to where investor sentiment lies, as China provides much of the spare capacity for commodities demand. If China's economy slows more strongly than expected, then commodities will feel the brunt of that and that has a big impact on commodity linked currencies like the Australian Dollar. ... В этой ситуации CAD выглядит привлекательнее, чем AUD As we had looked at previously, the growth divergence story between the US and China has helped the CAD to make sizable gains this month against the AUD, and we can see that fundamental trend continue if expectations around China continue to show disappointment. We'll continue to monitor Chinese equiteis to see if we have further follow through to the downside, as well as what impact that will have on commodities like copper, as well as the general US Dollar Index. ........................................................................................... About that broken ECB transmission mechanism... О разрушенном передаточном механизме ЕЦБ

|