|

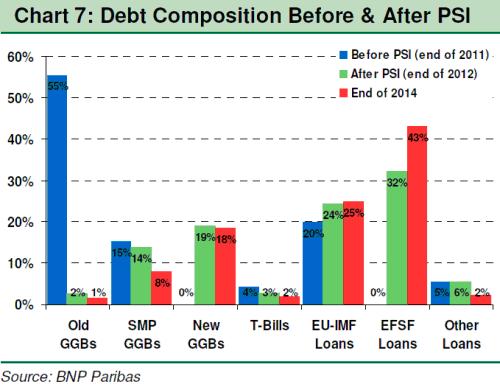

LINKS-ДАЙДЖЕСТ 15 марта 2012 г. Смаги: Португалии потребуется помощь Ирландия пытается уйти от долгов ЕС Райхенбах отчитается о проделанной работе в Греции Безработица в Греции обновила рекорд МВФ одобрил выделение Греции помощи Новотны: ЕЦБ не планирует дополнительных мер Госдолг Италии вырос до 2 трлн евро Нацбанк Швейцарии обещает неограниченные интервенции В США вышел целый спектр важных статданных Инвестиции в Китай падают четвертый месяц подряд Рынок акций Китая рухнул до трехнедельного минимума Назревший конфликт в Компартии Китая вырвался наружу Противоречия внутри Коммунистической партии Китая, информация о которых практически все время оставалась достаточно закрытой, стали достоянием широкой общественности. ЦК Компартии приняло решение об отстранении от должности одного из самых популярных китайских политиков, члена Политбюро Центрального Комитета КПК, руководителя парторганизации города Чунцин Бо Силая. .................................................................................... теперь англоязычные Важнейшая тема на рынке – миникрэш на рынке облигаций What The Bond Market Slump Means For Forex Что означает резкое падение цен на бонды для рынка Форекс What The Downfall Of Bo Xilai Means For China Что означает падение Bo Xilai для Китая Jeremy Siegel Sees Dow 17,500 By The End Of 2013 Зигель объясняет, почему у него такой бычий настрой по отношению к акциям: За последние 3-4 года столько денег притекло в бонды, что инвесторы должны испытывать беспокойство In an interview with Bloomberg TV, Siegel explained why he was so bullish on stocks: "...We know how much money has been flowing into those bonds funds over the last three or four years. All of a sudden they might get a little nervous and say where am i going to go? Where can i get some yield and also some protection against inflation and growth? and that's when I think we're going to see people fleeing the bond market moving into stocks." EX-ECB MEMBER: If EU Leaders Don't Do Two More Bailouts Soon, Europe Is Screwed Если Европа не создаст еще два пакета помощи, то ее ждет кризис After Huge Runup In Stocks, Goldman Tells Clients To Take One Of The Riskiest Bets Out There После сильного подъема в акциях Голдман предлагает клиентам вкладывать в них деньги. ........................................... Terminated CBO Whistleblower Shares Her Full Story With Zero Hedge, Exposes Deep Conflicts At "Impartial" Budget Office Про диссидентку в бюджетном комитете конгресса И вот самая важная статья: Here Is Why Everything Is Up Today - From Goldman: "Expect The New QE As Soon As April" Goldman Sachs вешает лапшу на уши клиентам: прогнозирует QE3 уже в апреле Confused why every asset class is up again today (yes, even gold), despite the pundit interpretation by the media of the FOMC statement that the Fed has halted more easing? Simple - as we said yesterday, there is $3.6 trillion more in QE coming. But while we are too humble to take credit for moving something as idiotic as the market, the fact that just today, none other than Goldman Sachs' Jan Hatzius came out, roughly at the same time as its call to buy Russell 2000, and said that the Fed would announce THE NEW QETM, as soon as next month, and as late as June. Что нужно делать. As for Goldman, if one ignores all of the below, the only thing to remember is that Goldman is now selling stocks to, and buying bonds from the muppets. Вопросы и ответы: с помощью которых GS пытается своих клиентов убедить, что QE3 будет уже возможно на следующем заседании ФОМС в апреле. Q: What is your current forecast for Fed policy? A: It has definitely become a closer call, but we still expect another asset purchase program that involves purchases of both mortgage-backed securities and Treasuries. This would expand the Fed's balance sheet, but its impact on the monetary base would likely be "sterilized." We expect this program to be announced in the second quarter, either at the April 24-25 FOMC meeting or the June 19-20 meeting. The argument for April is that this would leave more time before the end of the long-term bond purchases under Operation Twist (more formally known as the Maturity Extension Program), and would thereby reduce the risk of market disruptions as uncertainty about the Fed's role in the market rose. The argument for June is that this would allow Fed officials a bit more time to assess the state of the economy. After June, we believe the hurdle for more action rises, not so much because of the impending presidential election but more because a decision to wait until after the end of Operation Twist would signal greater comfort on the Fed's part with denying the economy additional stimulus. Это манипуляция сознанием... About Those Foreign-Law Greek Bonds... О сложной композиции греческих бондов, сформировавшейся после PSI  Goldman Again Selling Russell 2000 To Muppets Голдман снова продает Рассел 2000 марионеткам Spanish Housing Re-Plunging Испанский рынок недвижимости возобновил снижение It's Official - US, UK To Release Strategic Oil Stocks Это официально: Великобритания и США распечатали стратегические запасы нефти The "New Normal" American Dream Of Renting Is About To Become Very Expensive Ставшая новой реальностью американская мечта о съеме дома скро станет чересчур дорогой. Jens Weidmann Defends Bundesbank Against Allegations Of TARGET2-Induced Instability Глава бундесбанка защищается от обвинений от нестабильности в связи с Target-2 What Do $100 Billion Of Ponzi Bonds Mean? Peter Tchir of TF Market Advisors про итальянские банки и рынок госдолга So Italian banks have issued about $100 billion of these ponzi bonds and even in this day, that is a big number. Banks issue bonds to themselves. Then they get an Italian government guarantee. Then they take those bonds to the ECB and get money, which I assume they use to pay down other debt mostly. The Italian banks and Italian sovereign debt markets are essentially becoming one and the same. The sovereign has added 100 billion of risk to the banks (that today no one is focused on) and the banks and ECB would have to come up with some new gimmick if the sovereign had problems. Рынки банковского долга и суверенного долга Италии стали практически одно и то же. These ponzi bonds ensure that Italian sovereign and bank spreads become 100% correlated over time. The fact that LTRO has daily variation margin adds to the death spiral. The fact that the ECB's outright holdings will be made senior to other holders is also an issue. I have lost track of what the EFSF or ESM are currently doing, or plan to do, but some money is being used up on the latest Greek bailouts, and the reluctance to pre-fund it, means that risk of the market rejecting EFSF or ESM bonds at times of crisis remains high. Шансы, что рынки откажутся от бондов EFSF и ESM в момент кризиса остаются велики. Investment Grade Bonds And The Retail Love Affair Peter Tchir of TF Market Advisors пишет про различные сегменты рынка бондов Without a doubt, retail has fallen in love with corporate bonds. Fund flows were originally into mutual funds, and have shifted more and more into the ETF’s. The ETF’s are gaining a greater institutional following as well – their daily trading volumes cannot be ignored, and for the high yield space, many hedgers believe it mimics their portfolio far better than the CDS indices. The investment grade market looks extremely dangerous right now as the rationale for investing in corporate bonds – spreads are cheap – and the investment vehicles – yield based products. И про рынок казначейских облигаций I do not like the move in treasuries. ZIRP can hold down the short end of the curve. Operation Twist can help keep the longer end anchored and focused on the short end, but that is more difficult to accomplish. The further out the curve, the less control the Fed has. With LQD having a very long duration and trading at a premium to NAV, I think there is room for more weakness here. Investors will learn that investment grade bond investments can lose money even as spreads tighten. Is This The Chart That Has Bernanke So Worried? Не этот ли график так обеспокоил Бернанке?  Индекс S&P500 с нового года сильно разошелся с экономическими данными. Будет ли повторение сценария прошлого года? .......................................... Preview: US CPI - Higher Energy Prices A Negative for Economy Net Long-Term Foreign Inflows Rise on Treasuries US TIC data showed net long term inflows of $101bn in Jan, the first triple digit net flow since August 2010. U.S. Producer Prices Rose in February; Initial Jobless Claims Fell in the Week Ending March 10 Higher Energy Prices Boost PPI in February Высокие цены на энергию ускорили инфляцию в феврале SNB Reiterates Commitment to EURCHF "Floor" SNB повторил заявление о привязке CHF Preview: 3 Key Factors Heading Into SNB Rate Decision Подробная статья на тему монетарной политики SNB (Центрального Банка Швейцарии) ........................................... China equilibrium *alert* В этом месяце наблюдается значительный рост волатильности юаня. Что это означает для экономики и рынков? This month has brought signals of a subtle regime change in the People‟s Bank of China‟s (PBoC‟s) management of the external value of the Chinese yuan (CNY). We have seen a considerable upturn in the volatility of the daily PBoC fixes for USD-CNY and, more specifically, two sharp fix-to-fix CNY losses. By and large, that China’s highly manipulated currency market is on the verge of ‘equilibrium’. That’s to say, the country is no longer attracting enough dollar inflows to justify its long-orchestrated currency manipulation, a.k.a Treasury buying... a.k.a Chinese-led US quantitative easing. И по этой же теме http://brucekrasting.blogspot.com/2012/03/is-ten-year-going-to-3.html Китай сократил покупку американского госдолга. Кто теперь будет его покупать? As a result of the shrinking trade surplus and the need to import expensive crude, China does not have the investable dollars it once had. So it is no longer buying US Treasuries at the previous fast pace. At the same time, the US Treasury is issuing debt at the rate of $100B a month. If the Chinese aren’t buying debt, then it must be sold to other dollar holders. The AUD is not your friend По поводу австралийского доллара The Australian dollar has long been seen as a China/commodities trade, but Macquarie’s Brian Redican reckons that’s no longer the case. The currency is increasingly influenced by external factors, rather than the country’s own ever-growing mining sector, or its monetary and fiscal policy. And this, he says, is a momentous shift — so much so that Macquarie now sees the AUD remaining around its current levels for several years, and only gradually sliding to $1.05 by 2015. Their previous forecast was a fall below USD parity by the end of this year. 75% австралийского выпуска бондов находится за рубежом It’s now reached the point where 75 per cent of national government bond issuance is held offshore. And yields are high against other AAA sovereign bonds: close to 4 per cent for 10-year maturities. В дополнение темы: речь заместителя главы ЦБ Австралии The Changing Structure of the Australian Economy and Monetary Policy ................................................ - China’s Foreign Direct Investment Falls for Fourth Month (Bloomberg)

- Greek Restructuring Delay Helps Banks as Risks Shift (Bloomberg)

- Concerns Rise Over Eurozone Fiscal Treaty (FT)

- Home default notices rise in February: RealtyTrac (Reuters)

- China PBOC Drains Net CNY57 Bln (WSJ)

|